We spent 12 nights exploring Madrid, Seville, and Barcelona on our recent trip to Spain.

We did a lot of shopping!

If you’ve ever shopped abroad in the European Union, you’ve likely encountered VAT without realizing what it is or how it affects your purchases.

In this post, we will break down what VAT really means, how it works, and the different rates you might come across.

Plus, we’ve got a special tip for non-EU residents on how you can claim a VAT refund, potentially saving you a significant amount of money.

Whether you’re a seasoned shopper or a curious tourist, this guide will arm you with the knowledge to navigate VAT like a pro and make the most of your trip abroad!

What is VAT?

VAT stands for Value Added Tax, and it’s pretty much everywhere when you shop in countries like Spain and those in the European Union.

VAT rates can vary wildly depending on where you are and what you’re buying. It’s applied broadly across most goods and services.

Necessities might have lower rates or none at all (like some foods or books), while other items are taxed at the standard rate, which could be as high as 27% in some EU countries.

You’ll typically see VAT applied to things like:

- Retail Goods: Clothing, electronics, etc.

- Services: Hotel accommodations, restaurant meals, and transport services.

- Luxury Items: Jewelry, artwork, and high-end electronics.

- Daily Essentials: In some regions, even groceries, pharmaceuticals, and other necessities may have VAT.

Each country decides its own VAT rates and categories.

So, you can see why it’s important to understand the process for requesting a refund.

Who is eligible for a VAT refund?

Non-EU citizens are eligible for a VAT refund on purchases made within the EU, under certain conditions.

Here are the main eligibility criteria:

Residency: You must be a resident outside the EU. This generally needs to be verified with your passport or other identification.

Minimum Purchase Amount: Most EU countries require that you spend a minimum amount in a single store on the same day to qualify for a VAT refund. This amount varies by country. In Spain, for instance, there is no minimal spending amount.

Export of Goods: You must export (take them) the purchased goods out of the EU within a specific time frame, usually within three months of purchase.

Customs Validation: Before leaving the EU, you must have your Tax-Free Forms stamped or validated by customs to prove that the goods are leaving the EU.

This may mean you’ll need to show the goods, your receipts, and your completed Tax-Free Forms at the customs desk at the airport or border crossing. Nowadays everything is digital.

If you’re buying things like clothes or accessories, you likely won’t need to show these at customs, but I would keep them on you just in case.

Expensive items or electronics like laptops or cell phones will likely need to be physically verified by customs.

Purchases Eligible for VAT Refunds

For tourists, not all VAT-paid goods are eligible for refunds upon leaving the country.

Goods Only: Services, like hotel stays and meals, are generally not eligible for VAT refunds.

Unused and Exported Goods: The purchased goods must be unused and taken out of the country, usually within three months of purchase.

Basically, if you’re buying purses, clothes, watches, jewelry, or something like that then you’re likely eligible for a refund.

Shopping and Getting the VAT Tax-Free Form

When you’re shopping around Spain, make sure that you ask in-store (preferably before purchase) whether they participate in the VAT Refund program. Not all retailers participate in the program.

If they do, great! If not, at least you asked.

If they do participate, they will ask for your passport and personal information.

Several companies specialize in processing VAT Refunds. The store that we went to used Global Blue.

Global Blue made the process extremely simple. I downloaded the app and everything needed to process the VAT Refund was available just as the store entered it.

I chose to have the refund done via credit card and did not need to pay a processing fee. In some cases, if you want the refund in cash, they will take out a percentage.

We were given our paperwork and receipt which we kept, but if for some reason we did lose it I was confident that the information on the app would be all that we needed to complete the process.

Arriving at the Madrid Airport – MAD

Since we were leaving the European Union from Spain and heading back to the States, we completed customs validation at the Madrid Airport.

If you are hopping to another country within the EU, you don’t need to complete the process when departing from Spain.

You should wait until you are leaving the EU to validate all of your items purchased in countries with the European Union.

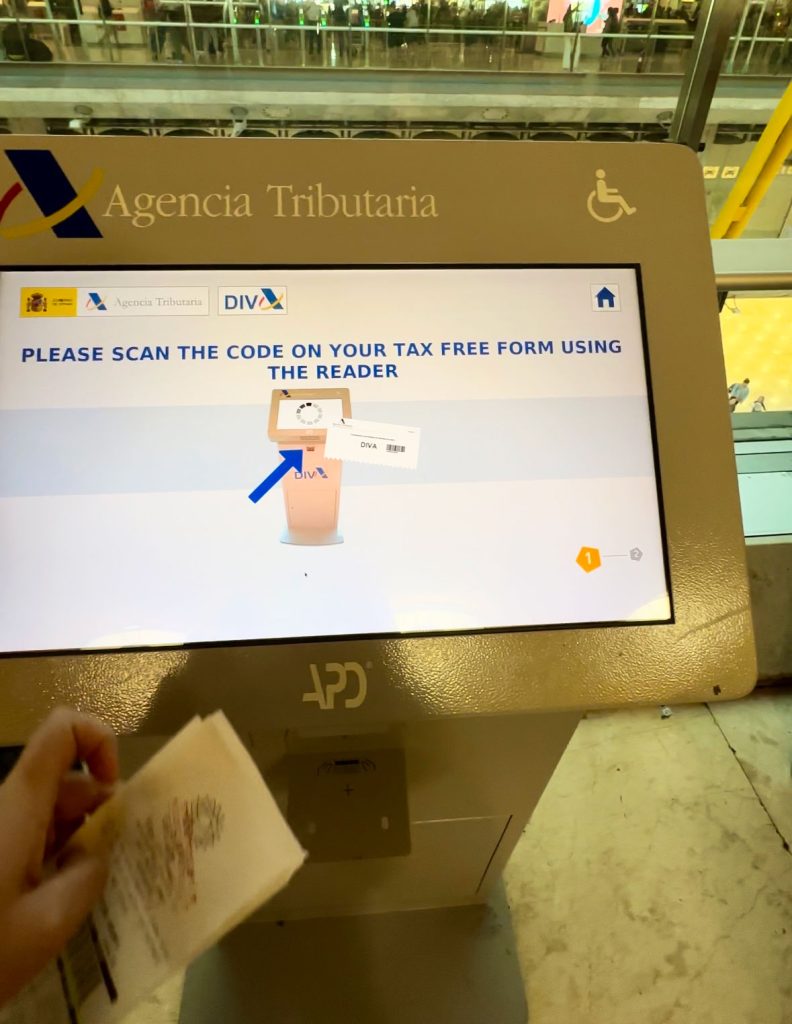

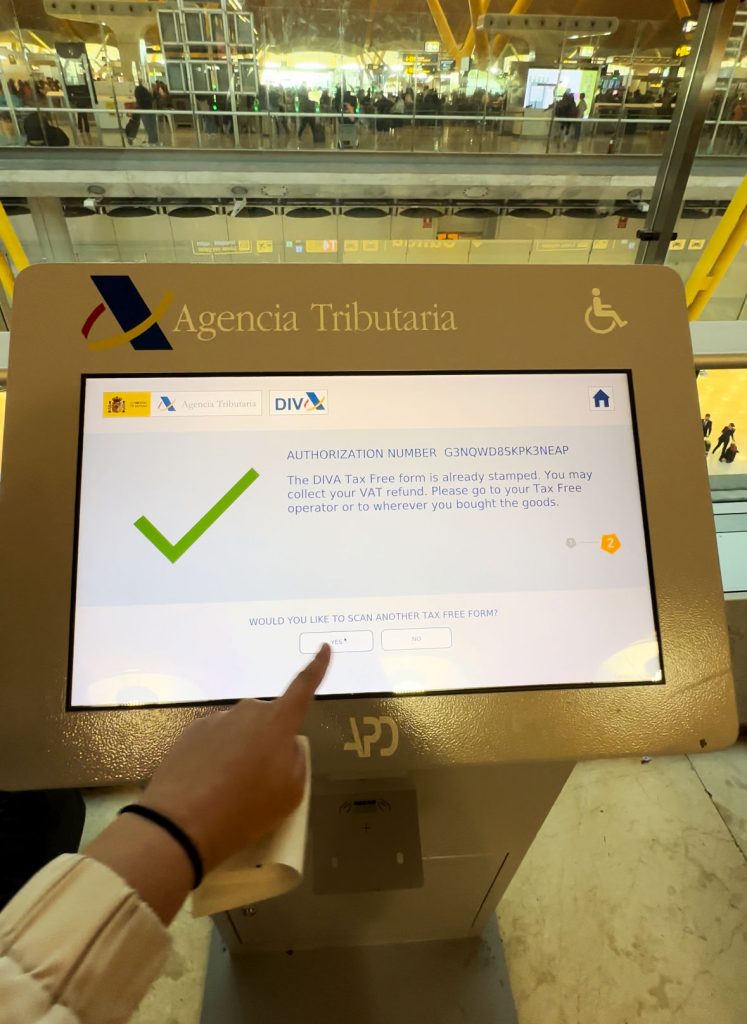

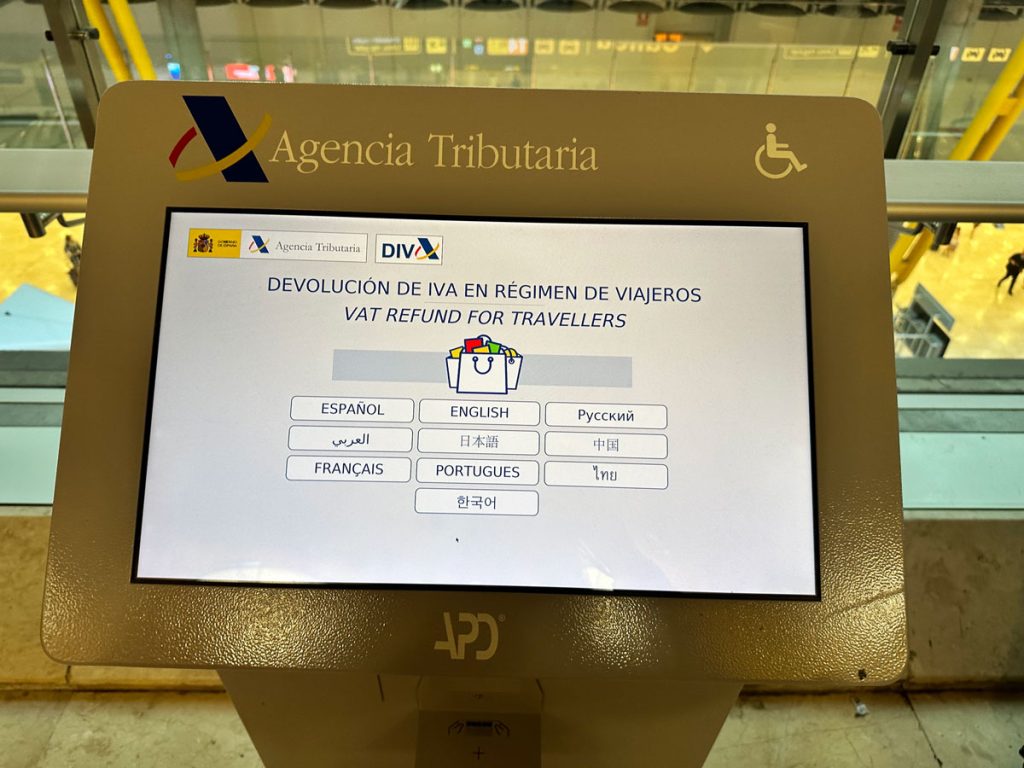

After checking in our bags (we kept our items with us), we had no problems finding a DIVA kiosk for self-validation.

The process was simple, we scanned the bar code on the receipt and were given the green check mark.

The green check mark meant that customs had validated our items and our refund would be processed. I saw the refund on my credit within 5 business days, super quick!

If we had been given a red X then we would have needed to take our items to the customs office for validation.

Do you need to keep your items with you for validation? If you’ve purchased clothes, shoes, or inexpensive items then you will likely not need to show your items for validation.

However, if you’ve purchased expensive items or electronics like laptops or cell phones it’s more likely that you will be directed to the customs office for validation.

Common Pitfalls and How to Avoid Them

Claiming VAT back in Spain can be a smooth process if you’re aware of the common pitfalls and how to avoid them.

Not Checking Eligibility: Don’t be like me! We spent $300 at a store and completely forgot to ask if they do VAT Refunds (facepalm).

So, I recommend that the first thing you do when you step into a store is ask whether they participate in the program. Not all retailers will have a “Tax-Free shopping” sign.

The good news is that even if you forget, as long as you have the receipt, you can go back to the store and complete the process if the store participates.

You cannot complete the process online or anything like that. You must start the process in person at the store.

Not Bringing Your Passport: You must have your actual passport or another form of eligible identification for the store to process your tax-free form. A photo may not cut it. I always keep my passport with me in an antitheft purse.

Failing to Meet Minimum Spend Requirements: Each country has a minimum purchase amount to qualify for a VAT refund. The store can tell you, but you can also see the minimums for the country you’re visiting by going to the VAT website or one of the processing services like the Global Blue website.

Improper Documentation: Incomplete forms or missing receipts can lead to a denied VAT refund. Now that everything is digital it’s much harder for this one to happen. To be safe, make sure you keep all documentation given to you by the store.

Packing Purchased Goods Incorrectly: You won’t always need to have the items with you for customs validation, but you should keep them in your carry-on just in case.

Missing Customs Validation: Please do not forget to scan the barcode at a DIVA kiosk. If you don’t get that green check mark or a stamp from customs then you will not receive your refund.

Allow extra time in case you need to visit the customs office for inspection before validation.

Ignoring Service Fees: If you don’t need the cash, opt to get the refund via a credit card electronically. This option usually comes without unnecessary processing fees. Get that money!

Planning a Trip to Spain?

If you’re planning a trip to Spain, I have several blog posts to help you plan an amazing and affordable trip!

- Things I wish I had known before traveling to Europe

- Flying Iberia Business Class Miami to Madrid

- Take the highspeed train from Madrid to Seville

- Fly from Seville to Barcelona on Vueling

- Find free things to do in Barcelona

- Take the highspeed train from Barcelona to Madrid

- Visit Barcelona on a budget

- My experience from Madrid to Miami on Iberia